IRS wage garnishment is the legal process by which the IRS deducts a portion of your paycheck to satisfy unpaid tax debts. You can stop IRS wage garnishment by responding quickly to IRS notices, requesting a payment plan, proving financial hardship, or using legal appeal rights—all before the IRS wage garnishment starts or by negotiating release after it begins.

2025 Updates

- Social Security Wage Base: For 2025, the wage base limit is $176,100. Medicare tax rate remains at 1.45% (no base limit). These directly influence calculations for disposable income and levy amounts.

- Notice Timeline: IRS still requires you to receive a Final Notice of Intent to Levy and Right to a Hearing (Letter 1058 or LT11) 30 days before IRS wage garnishment begins. No significant changes here.

- Installment Plans: Terms for online payment agreements and offers in compromise remain accessible. Fees/costs vary by income and are updated annually.

- Electronic Application: Online application options for payment plans and appeals expanded for 2025.

Find the latest IRS wage levy details on the official IRS levy policy page and IRS Publication 15.

What Is IRS Wage Garnishment?

IRS wage garnishment means the IRS instructs your employer to withhold a designated part of your paycheck to cover unpaid federal tax debt. This follows several written notices and legal procedures. IRS wage garnishments are continuous until the debt is paid or an alternative arrangement is made.

- Applies only to federal tax debts, not private credit or state agencies.

- Begins only after you receive official written notice and a 30-day window to act.

Who Is Affected?

- Any U.S. taxpayer with unpaid federal income tax and unresolved IRS notices.

- Most affected: Employees rather than independent contractors, as IRS wage garnishment occurs via payroll.

- Both active workers and retirees receiving eligible income may be subject.

How Much Can the IRS Garnish?

The amount is based on your filing status, the number of dependents, and the IRS’s living standards. The IRS ensures that a minimal standard deduction is left for basic living expenses. No flat rate applies—the amount varies by the individual’s Form 1040 completion and dependents.

- Example: If the standard deduction for singles is $15,750 in 2025, only income above that—minus allowed expenses—may be garnished.

- Your pay stub must indicate IRS wage garnishment deductions.

Methods to Stop IRS Wage Garnishment

You can halt or prevent IRS wage garnishment by taking one or more proven actions:

- Pay your tax debt in full before the IRS wage garnishment begins.

- Request and negotiate an IRS installment agreement (payment plan).

- Apply for “Currently Not Collectible” status if you prove financial hardship.

- Submit an Offer in Compromise to settle for less than you owe if eligible.

- Promptly file a Collection Due Process (CDP) hearing request within the 30-day window after Final Notice.

- Challenge the IRS wage garnishment in court if you qualify for exemption.

- Utilize the IRS Collection Appeals Program (CAP) for post-garnishment disputes.

Comparison Table: IRS Wage Garnishment Relief Options

| Method | Who It’s For | Key Requirements/Specs | Cost/Fees | How to Apply/Use | Typical Timeframe | Pros | Cons |

|---|---|---|---|---|---|---|---|

| Direct Payment | Taxpayers can pay in full | No eligibility, full balance required | None | Pay the IRS directly or via EFTPS | Immediately upon receipt | Stops IRS wage garnishment fast | May not be affordable |

| Installment Agreement | Most with a steady income | Must disclose financials, propose payments | Setup fee ($31 online), interest, and penalties continue | Apply online or via IRS Form 9465 | 1 day to several weeks after approval | Stops IRS wage garnishment, protects credit | Interest/fees accrue |

| Offer in Compromise | Financially distressed | Strict eligibility, extensive documentation | $205 app fee, possible deposit | Submit IRS Form 656 & docs | 4–6 months typical | May sharply reduce liability | Complex, low acceptance rate |

| CNC (Hardship Status) | Severe hardship cases | Must prove income below IRS threshold | None | Submit financial info to IRS, request status | 1–4 weeks after review | Temporary relief halts collections | Debt remains, reviews annually |

| CAP/CDP Appeal | Any taxpayer receiving a levy notice | Must act within 30 days | None | Request a hearing via an IRS notice | IRS wage garnishment paused after filing | Asserts rights, halts IRS wage garnishment | Limited to process disputes |

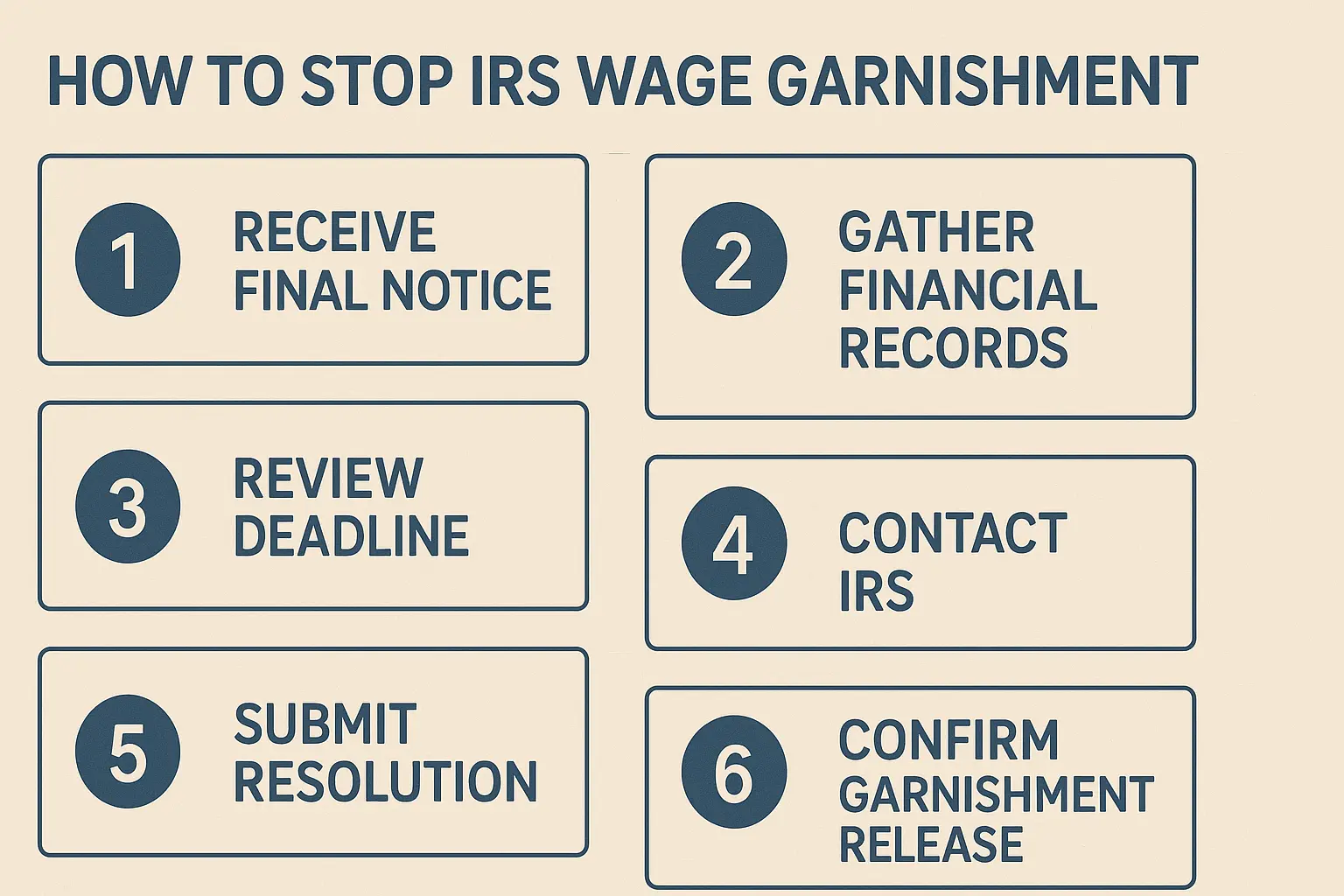

Step-by-Step Checklist to Halt IRS Wage Garnishment

- Review Your IRS Notices: Confirm you’ve received a Final Notice of Intent to Levy (Letter 1058/LT11).

- Check the Date: Identify your 30-day window for response.

- Collect Financial Records: Gather paystubs, tax returns, proof of expenses, and dependents.

- Contact the IRS or an Authorized Agent Quickly: Use the number on your notice or apply online for a payment plan.

- Submit the Preferred Resolution:

- Payment in full via IRS, EFTPS, or your financial institution.

- Proposed Installment Agreement or Offer in Compromise with relevant forms.

- Request the Currently Not Collectible (CNC) status if experiencing hardship.

- File for a Collection Due Process (CDP) hearing if it is within 30 days of your levy notice.

- Follow Up Consistently: Monitor communications and confirm the release or pause of IRS wage garnishment.

- Document Everything: Keep records of IRS correspondence, application status, and payments.

Typical Timeline:

- From the notice date, you have 30 days to act. Payment plan setup may stop IRS wage garnishment within days to weeks. Appeals halt IRS wage garnishment pending outcome.

Costs, Risks, and Limitations

- Direct Payment: No fees; full payment of the debt is required.

- Installment Agreement: Setup fee ($31 online in 2025; higher for paper), continued interest and penalties until paid.

- Offer in Compromise: $205 application fee; deposit required unless low-income; approval may take months.

- Hardship Status (CNC): No fee; periodic review by IRS, debt remains.

- Legal Appeals (CAP/CDP): No direct fees; legal representation may have costs.

Ongoing Risks:

- IRS wage garnishments continue until the IRS approves the resolution.

- Late/failed responses can result in loss of legal rights and deeper garnishment.

- Interest and penalties accrue on unpaid balances during the plan.

- IRS wage garnishment may impact credit, job stability, and household finances.

Compliance/Eligibility:

- All plans require an IRS review of income and ability to pay.

- Appeals are available only within a specific notice window.

- An Offer in Compromise is reserved for those who demonstrate an inability to pay the full amount.

Troubleshooting & Changing Your Arrangement

- To modify or pause a payment plan, contact the IRS via the account portal or by phone.

- To cancel or switch methods: Inform the IRS in writing, citing financial changes.

- If IRS wage garnishment is misapplied or continues after resolution, appeal using CAP or consult a tax attorney.

- Upgrade/downgrade: If your circumstances change, update the IRS with the latest financial info.

Alternatives & When to Use Them

- Bankruptcy: Instantly halts all collection proceedings, but impacts credit and assets; consult a bankruptcy attorney.

- State Tax Programs: If debt relates to state taxes, investigate state hardship relief or payment plans.

- Nonprofit Credit Counseling: May aid with other debts if the tax alone isn’t the problem.

- Court Challenge: If you qualify for an exemption or dispute the IRS calculation, seek legal representation.

Find eligible alternatives by reviewing official IRS collections and appeals details.

Worked Example

Jane Smith

- Standard Deduction: $15,750 (single)

- Monthly Disposable Income: $3,000

- IRS Debt: $8,000

Jane receives a Final Notice of Intent to Levy. She applies online for an Installment Agreement at $250/month ($31 setup fee), submitting Form 9465, pay stubs, and expense summary. IRS halts IRS wage garnishment after confirming the plan within 5 business days.

Result: IRS wage garnishment replaced by manageable monthly payments; avoids job disruption; debt paid over 32 months plus interest.

Common Mistakes & Pro Tips

Mistakes:

- Ignoring IRS notices or missing deadlines.

- Underestimating the cost and duration of installment plans.

- Not submitting complete financial documentation.

- Failing to request an appeal or hardship status within the designated window.

Pro Tips:

- Respond within 30 days of your levy notice.

- Keep all IRS correspondence and record submission dates.

- Use the IRS’s online portals for faster resolution.

- Consider professional help for complicated cases or large debts.

- Schedule regular financial checkups to adjust plans if needed.

Call to Action

Protect your income:

- Apply for an IRS payment plan online or call the IRS agents as soon as you receive notice.

- Compare relief options on the official IRS settlement programs page.

- Download official IRS forms and guidance before submitting your application.

- Consult a licensed tax professional if you need personalized advice or representation.

FAQs

What is IRS wage garnishment?

IRS wage garnishment is when the IRS directs your employer to withhold part of your paycheck to repay tax debt.

How do I stop IRS wage garnishment quickly?

Contact the IRS within 30 days of your Final Notice. Propose a payment plan, hardship status, or other relief option.

How much will be garnished?

Amounts vary based on filing status, dependents, and deductions. Only income above your standard deduction is targeted.

Can I appeal an IRS wage garnishment?

Yes. You have 30 days from the date of your Final Notice to request a Collection Due Process hearing.

What if I miss the 30-day window?

IRS wage garnishment will begin. But you can still contact the IRS to set up a payment arrangement or request a hardship review.

Does bankruptcy stop IRS wage garnishment?

Yes. But it carries significant long-term consequences for credit and assets. Seek legal counsel.

How soon does IRS wage garnishment stop after applying for a plan?

It may take days to weeks after approval, depending on the IRS processing time.

Will IRS wage garnishment affect my credit?

Yes. An ongoing IRS wage garnishment may appear on public records and affect creditworthiness.

Can garnished wages be refunded?

Possibly. Only if IRS wage garnishment was in error and is successfully appealed or reversed.

Are all wages subject to IRS wage garnishment?

Most standard W-2 wages are eligible. Some benefits and retirement income are excluded.

Is professional help required?

Not always. But hiring a tax attorney or CPA can expedite complex cases or appeals.

How do I check the current IRS wage garnishment rules?

See official IRS resources and Publication 15 for annual updates.

Sources

- IRS Official Wage Garnishment Levy Policy

- IRS Publication 15 – 2025

- IRS Installment Agreement Guides

- Collection Due Process (CDP) Hearing Info

- Offer in Compromise Program

Disclaimer, Author & Update Log

Educational Only: This guide provides general information for educational purposes and does not constitute legal or financial advice. Always consult a licensed tax professional or attorney for advice specific to your situation.

Author:

Team CTR

Published: November 13, 2025

Last reviewed: November 13, 2025

Last updated: November 13, 2025