Blogs

Stay informed with the latest insights and tips on tax resolution, financial planning, and IRS updates. Our blog is dedicated to providing valuable information to help you navigate the complexities of tax debt and make informed decisions for your financial future.

The Ultimate Guide to Child Tax Credit & How to Claim It

The Child Tax Credit is one of the most significant financial lifelines for families in the United States, offering essential support as the cost of raising children continues to climb. In recent years—especially in the wake of the pandemic and amid persistent inflation—this credit has become even more crucial. For millions of parents and guardians,...

Tax Credits vs. Deductions: Don’t Leave Money on the Table

Are you leaving money on the table during tax season? Every year, millions of Americans miss out on valuable tax savings simply because they don’t fully understand the difference between tax credits and tax deductions. While both can lower your tax bill, knowing how each works—and how to maximize them—can lead to significant savings.This article...

Top 10 Tax Deductions to Lower Your IRS Tax Bill

Tax deductions play a crucial role in reducing your tax liability by allowing you to subtract certain expenses from your taxable income. By taking advantage of these deductions, you can significantly lower your IRS tax bill, which can lead to substantial savings. However, many taxpayers miss out on valuable deductions due to a lack of...

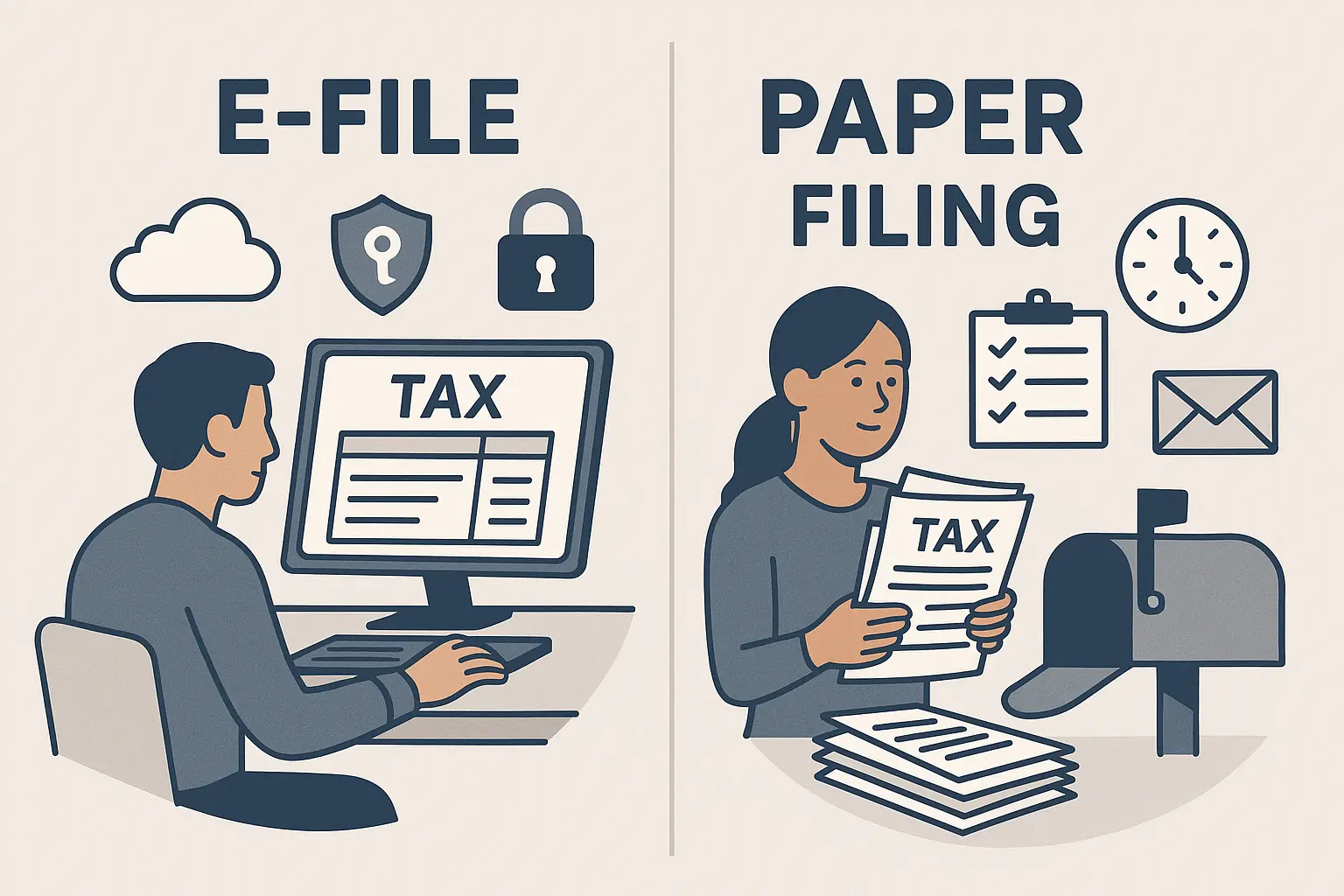

IRS E-File vs. Paper Filing – Which One is Better

Tax filing is a critical annual obligation for individuals and businesses in the United States. The Internal Revenue Service (IRS) provides two primary methods for submitting tax returns: electronic filing (e-file) and paper filing. Both methods have advantages and disadvantages, making it essential for taxpayers to choose the one that best suits their needs.The importance...

How to Amend Tax Return (Form 1040X) If You Made a Mistake

Filing tax returns accurately is crucial for maintaining compliance with tax laws and avoiding unnecessary penalties. Despite the best efforts to ensure accuracy, mistakes can occur, whether due to oversight, incorrect information, or changes in tax laws. If you discover an error in your previously filed tax return, it’s essential to correct it by filing...

IRS Tax Filing Deadlines Important Dates You Should Know

Knowing IRS tax filing deadlines is crucial for individuals and businesses to avoid unnecessary penalties and interest. Missing these deadlines can result in significant financial consequences, including late filing and payment penalties, as well as accrued interest on unpaid taxes. For instance, if you owe taxes and fail to file or pay by the deadline,...

How to Check IRS Tax Refund Status: A Step-by-Step Guide

Checking the status of your IRS tax refund is crucial for managing your finances effectively. Tax refunds are a significant source of income for many individuals, and understanding how they work can help you plan better. Here’s why tracking your refund is important and how it works:Importance of Checking Your IRS Tax Refund StatusTracking your...

A Complete Guide to Filing IRS Tax Return Online: Part-I

Filing IRS Tax Return Online has surged in popularity due to its efficiency and convenience. Let’s explore why more taxpayers are choosing to file taxes online in 2025:Why Filing Taxes Online is PopularE-filing offers numerous advantages over traditional paper filing, including faster processing and refunds, reduced errors, and the ability to file from anywhere at...

A Complete Guide to Filing IRS Tax Return Online: Part-II

How to Track Your Refund After Filing IRS Tax ReturnAfter e-filing your tax return, it’s natural to want to know when you can expect your refund. The IRS provides tools to track your refund status, offering transparency and peace of mind.Using the “Where’s My Refund?” ToolThe IRS “Where’s My Refund?” tool is available on the...