Tax deductions play a crucial role in reducing your tax liability by allowing you to subtract certain expenses from your taxable income. By taking advantage of these deductions, you can significantly lower your IRS tax bill, which can lead to substantial savings. However, many taxpayers miss out on valuable deductions due to a lack of awareness or understanding of the available options.

Understanding and utilizing tax deductions effectively can make a significant difference in your financial planning. For instance, deductions can help reduce your taxable income, which in turn lowers the amount of taxes you owe. This can be particularly beneficial for individuals and businesses looking to optimize their financial strategies.

In this article, we will explore the Top 10 Tax Deductions that can help you lower your IRS tax bill. These deductions cover a wide range of expenses, from home office deductions to charitable contributions, and are designed to help you navigate the complex world of tax savings.

If you’re new to tax deductions or want a fundamental understanding of how they work, consider checking out Tax Deductions 101: How to Legally Lower Your IRS Bill for a comprehensive guide. This resource will provide you with the foundational knowledge needed to maximize your tax savings.

Standard Deduction vs. Itemized Deductions

When filing your federal taxes, you have two primary options for reducing your taxable income: the standard deduction and itemized deductions. Understanding the difference between these two can help you make an informed decision about which one to choose.

Standard Deduction

The standard deduction is a fixed amount that you can subtract from your income without needing to track specific expenses. It varies based on your filing status:

- Single filers and married filing separately: $14,600 for 2024 and $15,000 for 2025.

- Head of household: $21,900 for 2024 and $22,500 for 2025.

- Married filing jointly: $29,200 for 2024 and $30,000 for 2025.

The standard deduction is generally easier to claim and requires less paperwork, making it the preferred choice for about 90% of taxpayers.

Itemized Deductions

Itemized deductions involve listing specific expenses on Schedule A of your tax return. You should consider itemizing if your total itemized deductions exceed the standard deduction amount for your filing status. Common itemized deductions include:

- Mortgage interest and real estate taxes.

- State and local taxes (up to $10,000).

- Medical expenses exceeding 7.5% of your adjusted gross income.

- Charitable contributions.

Itemizing can be more beneficial if you have significant expenses in these categories, but it requires more documentation and effort.

To better understand how to choose between the standard and itemized deductions, consider checking out a Step-by-Step Guide to Claiming Tax Deductions the Right Way. This resource will help you navigate the process and ensure you’re making the most of your tax savings.

Mortgage Interest Deduction

The mortgage interest deduction is a valuable tax benefit for homeowners, allowing them to deduct the interest paid on their mortgage from their taxable income. This deduction can significantly reduce your tax liability, especially for those with substantial mortgage payments.

Eligibility for Deducting Mortgage Interest

To be eligible for the mortgage interest deduction, you must itemize your deductions on Schedule A of your tax return. The deduction applies to interest paid on mortgages for your primary residence and secondary residence, provided the secondary home is used for personal purposes and not solely as a rental property. For a second home to qualify, you must use it for more than 14 days or more than 10% of the days it was rented out, whichever is greater.

Limits on Deduction

The Tax Cuts and Jobs Act (TCJA) limits the mortgage interest deduction to $750,000 of qualified residence loans for single filers and married couples filing jointly, and $375,000 for married couples filing separately. This limit applies to mortgages obtained after December 15, 2017. For mortgages taken out before this date, the limit remains at $1 million for single filers and married couples filing jointly, and $500,000 for married couples filing separately.

How the IRS Calculates It

The IRS calculates the mortgage interest deduction based on the interest paid during the tax year on qualified mortgages. This includes interest on acquisition debt (used to buy, build, or improve a home) and home equity debt used for home improvements.

Example Scenario

Consider a married couple filing jointly with an annual gross income of $150,000 and annual mortgage interest payments of $10,000. By itemizing and deducting this interest, their taxable income would be reduced to $140,000. Assuming a marginal tax bracket of 22%, they would save approximately $2,200 in taxes. This example illustrates how the mortgage interest deduction can provide substantial tax savings for homeowners.

Medical and Dental Expenses

Medical and dental expenses can be deducted from your taxable income if they exceed a certain threshold set by the IRS. This deduction is a valuable option for individuals with significant medical bills.

Deductible Medical Expenses and IRS Threshold

To qualify for the deduction, your unreimbursed medical and dental expenses must exceed 7.5% of your adjusted gross income (AGI). For example, if your AGI is $60,000, you can deduct medical expenses above $4,500 (7.5% of $60,000). This means if you have $15,000 in medical bills, you can deduct $10,500 ($15,000 – $4,500) on your tax return.

What Counts as Qualified Medical Expenses

Qualified medical expenses include a wide range of services and products that alleviate or prevent physical or mental disabilities or illnesses. Examples include:

- Vision services: Eye exams, contact lenses, and prescription sunglasses.

- Dental expenses: Uninsured dental treatments that prevent or alleviate dental disease.

- Medical procedures: Surgeries, hospital stays, and prescription medications.

How to Calculate and Claim the Deduction

To claim the deduction, you must itemize your deductions on Schedule A of your tax return. Calculate your total medical expenses for the year, then subtract 7.5% of your AGI to find the deductible amount. Keep all receipts and records, as they may be required in case of an audit.

State and Local Taxes (SALT) Deduction

The State and Local Tax (SALT) deduction allows taxpayers who itemize their deductions to subtract certain state and local taxes from their federal taxable income. This deduction helps avoid double taxation by excluding income already taxed at the state and local levels.

Deductible State and Local Taxes

Eligible taxes for the SALT deduction include:

- State and local income taxes.

- Property taxes on real estate.

- General sales taxes, though you can only claim either sales taxes or income taxes, not both.

Limitations Imposed by the IRS

The Tax Cuts and Jobs Act (TCJA) introduced a $10,000 cap on the SALT deduction for single filers and married couples filing jointly. For married couples filing separately, the limit is $5,000. This cap is set to expire at the end of 2025.

How to Maximize This Deduction Strategically

To maximize the SALT deduction, consider the following strategies:

- Itemize deductions: Ensure that your total itemized deductions exceed the standard deduction amount to make itemizing worthwhile.

- Prioritize high-tax years: If you have a year with unusually high state and local taxes, consider accelerating payments to maximize deductions within the $10,000 cap.

- Consider state-specific strategies: Some states have implemented workarounds, such as charitable funds that provide credits against state taxes, which can indirectly help manage your SALT deduction.

Business Tax Deductions

Business tax deductions are essential for small business owners and self-employed individuals to reduce their taxable income and save on taxes. These deductions can include a wide range of expenses, from office supplies to travel costs.

Common Tax Deductions for Small Business Owners and Self-Employed Individuals

Some of the most common business tax deductions include:

- Office Expenses: This includes supplies, equipment, and software necessary for business operations.

- Home Office Deduction: If you use a dedicated space in your home for business, you can deduct a portion of your rent or mortgage interest, utilities, and other expenses. The home office deduction can be calculated using either the regular method, which involves tracking actual expenses, or the simplified method, which allows for a deduction of $5 per square foot up to a maximum of $1,500.

- Travel and Meal Deductions: Expenses related to business travel, including transportation, lodging, and meals, can be deducted. However, meals are generally only 50% deductible.

- Business Insurance and Retirement Plans: Premiums for business insurance and contributions to retirement plans like SEP IRAs are also deductible.

How to Keep Records for Business-Related Tax Deductions

Maintaining accurate and organized records is crucial for claiming business tax deductions. Here are some tips:

- Track Expenses: Use accounting software or spreadsheets to categorize and track all business-related expenses throughout the year.

- Keep Receipts: Store receipts for all deductible expenses, including office supplies, travel costs, and business meals.

- Separate Personal and Business Expenses: Ensure that personal and business expenses are clearly distinguished to avoid confusion during tax preparation.

- Retain Records: Keep tax records for at least three years from the date you file your return, as recommended by the IRS.

To strategically plan your business tax deductions and minimize payments, consider checking out Smart Tax Strategies to Maximize Deductions and Minimize Payments. This resource will provide you with expert advice on optimizing your tax strategy and ensuring compliance with IRS regulations.

Retirement Contributions

Retirement contributions to plans like IRAs and 401(k)s offer significant tax benefits by reducing your taxable income. Here’s how these deductions work and their advantages:

Deductions for IRA, 401(k), and Other Retirement Plans

- Traditional IRAs: Contributions are tax-deductible if you meet certain income and employer-sponsored plan criteria. The deduction reduces your adjusted gross income (AGI) on a dollar-for-dollar basis.

- 401(k) and Other Employer Plans: Contributions are made with pre-tax dollars, reducing your taxable income for the year. This can lower your tax bracket and decrease your tax liability.

Tax Benefits of Maxing Out Contributions

Maxing out your retirement contributions can provide substantial tax advantages:

- Reduced Taxable Income: Contributions lower your taxable income, potentially moving you into a lower tax bracket.

- Deferred Taxes: Earnings in these accounts grow tax-deferred until withdrawal, which can be beneficial if you expect to be in a lower tax bracket during retirement.

How Retirement Contributions Reduce Taxable Income

When you contribute to a traditional IRA or a pre-tax 401(k), you’re using pre-tax dollars. This means that each dollar contributed reduces your taxable income by the same amount. For example, if you contribute $10,000 to a 401(k), your taxable income would decrease by $10,000, leading to lower taxes for that year. This strategy is particularly beneficial for those in higher tax brackets.

Charitable Contributions

Charitable contributions can significantly reduce your taxable income by providing a tax deduction for donations made to qualifying charities. Here’s how to claim these donations, the necessary documentation, and the limits on deductibility.

How to Claim Donations to Qualifying Charities

To claim charitable donations, you must itemize your deductions on Schedule A of your tax return. Ensure that the charity is recognized by the IRS as a 501(c)(3) organization. You can verify this using the IRS Exempt Organizations Select Check tool.

Documentation Needed to Qualify

For donations to be deductible, you need proper documentation:

- Cash Donations Under $250: A bank record, credit card statement, or written receipt from the charity with the date and amount is sufficient.

- Cash Donations of $250 or More: You need a contemporaneous written acknowledgment from the charity, including the amount donated and whether any goods or services were received.

- Non-Cash Donations: For donations over $500, you must complete Form 8283. If the value exceeds $5,000, an appraisal is required.

Limits on Deductible Charitable Contributions

The IRS limits charitable deductions based on your adjusted gross income (AGI):

- Cash Donations: Generally up to 60% of AGI, but may be limited to 20%, 30%, or 50% depending on the type of contribution.

- Non-Cash Donations: Gifts of appreciated property are generally limited to 30% of AGI.

Excess contributions can be carried over for up to five years.

Education-Related Tax Deductions

Education-related tax deductions and credits can significantly reduce your tax liability by offsetting the costs associated with higher education. Here’s an overview of the key deductions and credits available:

Tuition and Fees Deductions

Historically, there was a tuition and fees deduction, but it has not been available in recent years. However, taxpayers can still benefit from other education-related deductions and credits.

Student Loan Interest Deductions

The student loan interest deduction allows you to deduct up to $2,500 of interest paid on student loans from your taxable income. This deduction is available for both federal and private loans used to pay for qualified education expenses, such as tuition, fees, and room and board. The deduction is subject to income limits: single filers with a modified adjusted gross income (MAGI) below $80,000 and joint filers below $165,000 can claim the full deduction.

Explanation of the Lifetime Learning Credit and American Opportunity Credit

- American Opportunity Tax Credit (AOTC): This credit provides up to $2,500 per student for the first four years of higher education. It covers 100% of the first $2,000 in qualified expenses and 25% of the next $2,000. Up to 40% of the credit is refundable, meaning you can receive a refund even if you owe no taxes.

- Lifetime Learning Credit (LLC): This non-refundable credit offers up to $2,000 per tax return for qualified education expenses. It can be claimed for any year of higher education, including graduate studies, and is not limited to degree-seeking students.

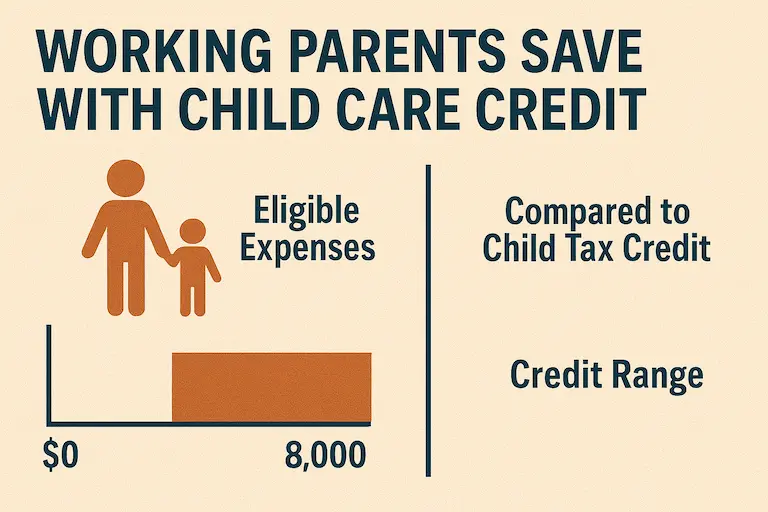

Child and Dependent Care Deduction

The Child and Dependent Care Credit is a valuable tax benefit for working individuals who pay for child care or dependent care expenses. Here’s how to claim this credit, the eligibility criteria, and the key differences between the Child Tax Credit and the Child and Dependent Care Credit.

How to Claim Deductions for Child Care Expenses

To claim the Child and Dependent Care Credit, you must meet certain requirements:

- Filing Status: Typically, you must file as Married Filing Jointly, though exceptions apply for Single, Head of Household, or Qualifying Surviving Spouse filers.

- Earned Income: You and your spouse (if applicable) must have earned income from a job or be looking for work.

- Qualifying Expenses: Expenses must be for care that allows you to work or seek employment, such as daycare or after-school programs.

Eligibility Criteria and IRS Limits

Eligible individuals include children under 13 and dependents who are physically or mentally unable to care for themselves. The credit is worth between 20% and 35% of qualified expenses, up to $3,000 for one dependent or $6,000 for two or more. The credit percentage decreases as income rises.

Difference Between Child Tax Credit and Child Care Deduction

- Child Tax Credit: A refundable credit of up to $1,000 per child under 17, aimed at offsetting the general costs of raising children.

- Child and Dependent Care Credit: A non-refundable credit for expenses related to child care or dependent care that allows you to work. Unlike the Child Tax Credit, it directly offsets taxes owed rather than reducing taxable income.

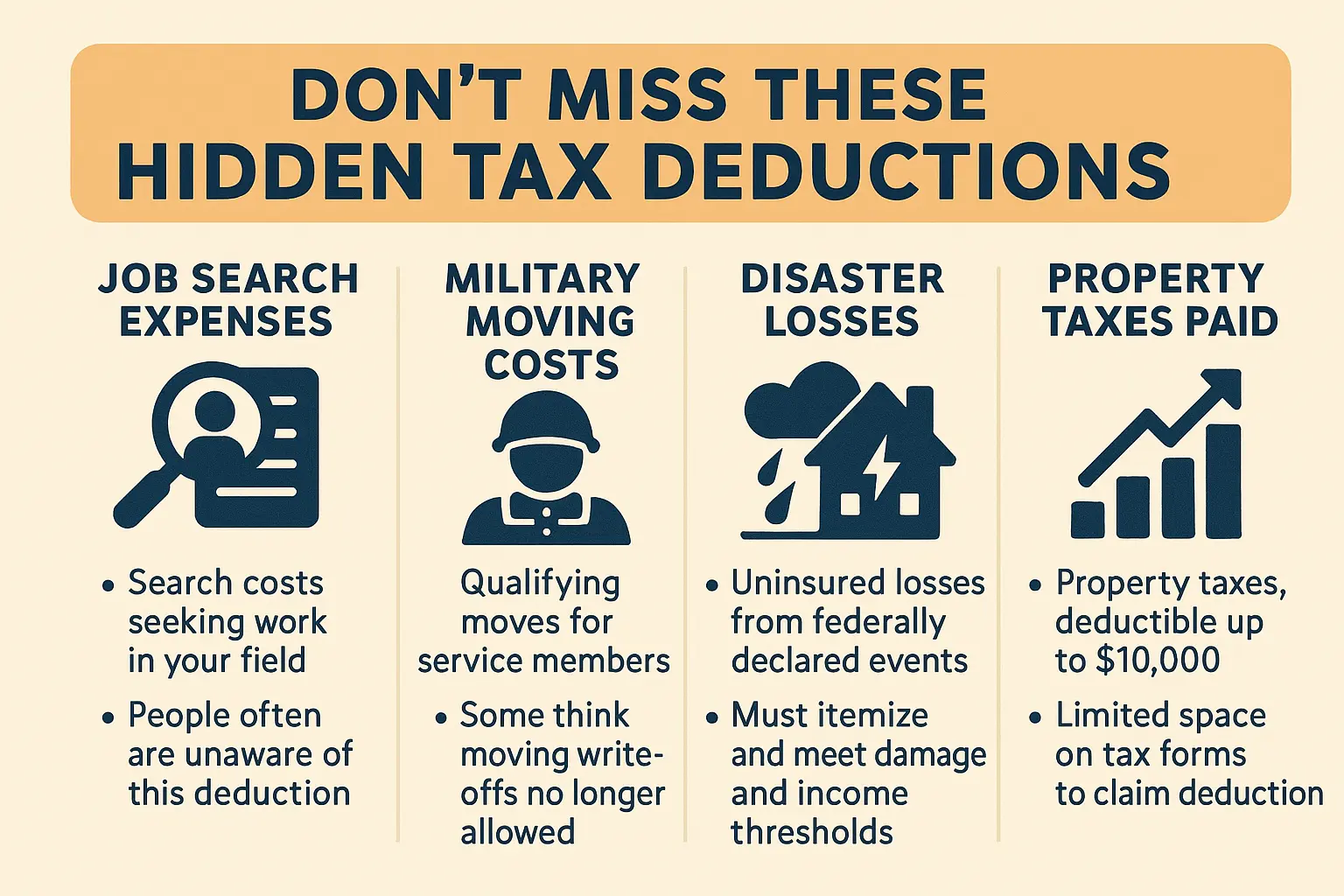

Miscellaneous Deductions You Might Be Missing

Many taxpayers overlook several miscellaneous deductions that can significantly reduce their tax liability. Here are some frequently missed deductions and a summary of why they are often overlooked.

Frequently Overlooked Tax Deductions

- Job Search Expenses: These include costs related to searching for a new job in your current occupation, such as resume preparation, travel expenses, and fees paid to employment agencies. However, these expenses must exceed 2% of your adjusted gross income to be deductible.

- Moving Expenses for Military Personnel: Active-duty military members can deduct unreimbursed moving expenses related to a permanent change of station. This includes costs for transporting household goods and personal effects.

- Disaster-Related Losses: Taxpayers affected by federally declared disasters may deduct personal casualty losses without itemizing deductions, subject to certain conditions.

- State Sales Taxes: Instead of deducting state income taxes, you can choose to deduct state sales taxes, which might be beneficial if you purchased large items like vehicles or boats.

- Reinvested Dividends: Some taxpayers overlook the fact that reinvested dividends can be considered taxable income, but they might also be eligible for deductions if they are part of a qualified retirement plan or other specific scenarios.

Summary of How Taxpayers Often Miss These Deductions

Taxpayers often miss these deductions due to a lack of awareness about what expenses qualify or because they fail to keep accurate records. Additionally, some deductions require specific conditions to be met, such as job search expenses needing to be in the same field as your current occupation.

To explore more hidden deductions and ensure you’re maximizing your tax savings, consider checking out 10 Overlooked Tax Deductions That Can Save You Money. This resource will provide you with a comprehensive list of often-overlooked tax breaks that can help you keep more money in your pocket.

Conclusion & Next Steps

Tax deductions are a powerful tool for reducing your tax liability and maximizing your financial savings. By understanding and utilizing the various deductions available, such as mortgage interest, medical expenses, and charitable contributions, you can significantly lower your IRS tax bill.

Recap of the Importance of Tax Deductions

Tax deductions not only reduce your taxable income but also help you manage your financial planning more effectively. They can provide substantial savings, especially for those with significant expenses in areas like healthcare, education, and business operations.

Encouragement to Work with a Tax Professional

To ensure you’re taking full advantage of all available deductions, consider working with a tax professional. They can help you navigate the complex tax landscape, identify overlooked deductions, and ensure compliance with IRS regulations.

Call to Action

For a comprehensive approach to claiming deductions properly, explore our Step-by-Step Guide to Claiming Tax Deductions the Right Way. Additionally, to discover more hidden savings opportunities, check out 10 Overlooked Tax Deductions That Can Save You Money. These resources will help you optimize your tax strategy and ensure you don’t miss out on valuable deductions.