The Earned Income Tax Credit (EITC) is a vital federal tax break for low- and moderate-income earners—helping millions of working Americans keep more of what they earn. If you wonder whether your household qualifies, how much you could get, or how to maximize your credit, this comprehensive guide will answer your questions and help you claim every dollar you’re eligible for.

Are you wondering if you qualify for this valuable tax credit? Here’s everything you need to know.

What is the Earned Income Tax Credit (EITC)?

The EITC is a refundable credit that lowers the amount of tax owed by eligible individuals and families and can result in a substantial refund. Its primary purpose is to encourage work and provide meaningful income support, especially for working parents.

Benefits of the EITC:

- Reduces or eliminates federal tax liability.

- Can trigger a refund, even if you owe no tax.

- Especially valuable for families with children.

Quick Comparison: EITC vs. Other Credits

While credits like the Child Tax Credit or Dependent Care Credit target specific needs, the EITC is unique for being fully refundable and largest for qualifying workers with children.

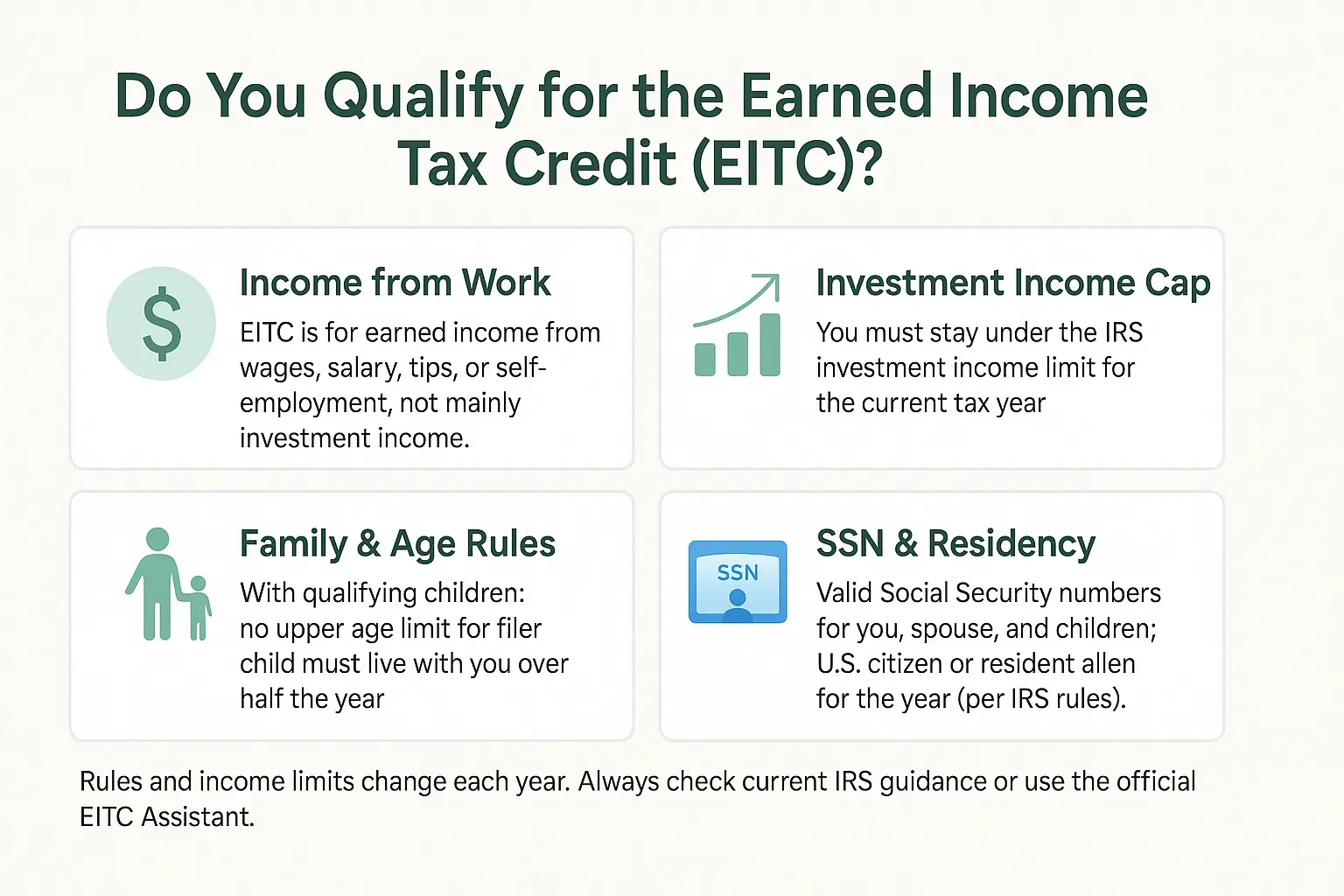

Who Qualifies for the EITC?

EITC eligibility is based on several factors:

- Income limits: Thresholds vary by filing status and number of qualifying children. Income must be primarily from work (not investments).

- Investment Income Cap: Investment income must not exceed a set threshold ($11,950 for 2025).

- Filing Status: Single, married filing jointly, head of household, and certain separated spouses qualify.

- Age Requirements:

- With no children: must be at least 25 but under 65 by year-end.

- With children: no age limit for the filer.

- Qualifying Children: Increases benefit if living with you for over half the year and meet age/relationship tests.

- No Children: Single or married filers with low income can still qualify for a smaller credit.

- Residency: U.S. citizen or resident alien all year.

- Social Security Numbers: You (and spouse, if filing jointly) and all qualifying children must have valid SSNs.

EITC 2025 Income Limits (Federal EITC)

| Filing Status | No Children | 1 Child | 2 Children | 3+ Children |

| Single/Head, Married Joint | ≤$19,104 | ≤$50,434 | ≤$57,310 | ≤$61,555 |

Always refer to the official IRS tables each tax year for precise phase-out thresholds.

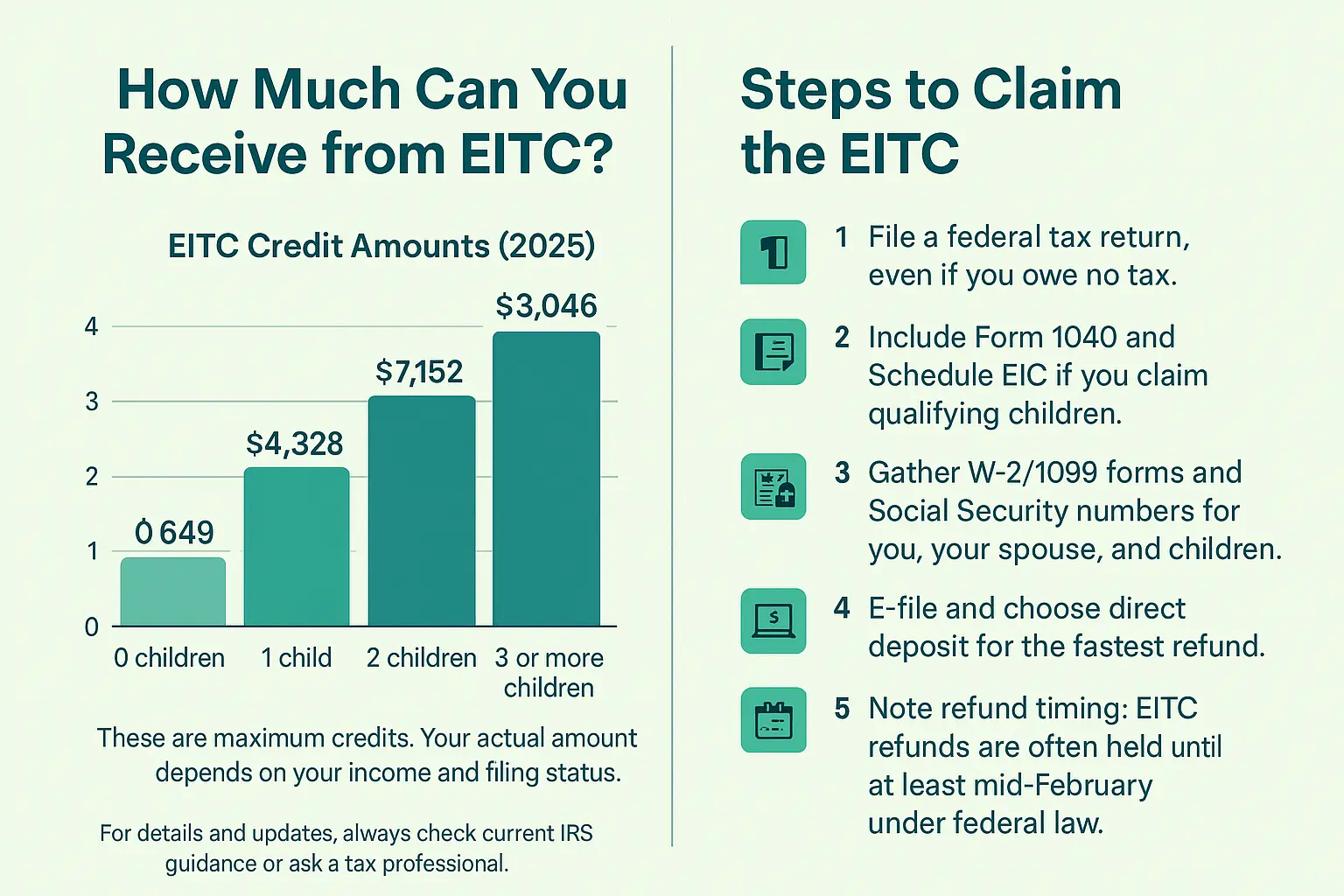

How to Apply for the Earned Income Tax Credit (EITC)

Step-by-Step Guide

- File a Federal Tax Return

- You must file, even if you owe nothing.

- Use Form 1040

- Complete your return. If claiming children, fill out Schedule EIC.

- Gather Documentation

- W-2s, 1099s, Social Security numbers, proof of child residency if claiming children.

- Enter EITC Info Correctly

- On Form 1040, claim EITC in the designated section and provide child info on Schedule EIC.

- E-file for Speed

- E-filing with direct deposit is fastest, but paper filing is possible.

- Get Help if Needed

- Use trusted tax software, a professional preparer, or free help through VITA (Volunteer Income Tax Assistance) or AARP Tax-Aide.

Tip: The IRS EITC Assistant can help you check eligibility before filing.

Common Mistakes to Avoid When Applying for the EITC

- Reporting incorrect earned income.

- Claiming children who don’t meet residency, relationship, or age requirements.

- Failing to provide correct Social Security numbers.

- Missing filing deadlines.

- Overlooking investment income caps.

How to Avoid Errors:

- Triple-check information.

- Use IRS checklists and the EITC Assistant.

- Seek professional or VITA help if you’re unsure.

How Much Can You Receive from the EITC?

EITC Credit Amounts (2025)

| Number of Children | Maximum Credit |

| 0 | $649 |

| 1 | $4,328 |

| 2 | $7,152 |

| 3 or more | $8,046 |

EITC Calculation Example:

- Maria, single with 2 children, earns $23,000:

- Likely eligible for $6,800–$7,152, depending on exact income and other factors.

- Jake, married without children, earns $15,000:

- Eligible for up to $649 if all other requirements are met. He must be between ages 25 and 64, and both spouses need valid SSNs

When Will You Receive Your EITC Refund?

- Most EITC refunds are paid within 21 days of e-filing.

- By law, EITC refunds (and those claiming the Additional Child Tax Credit) are not issued before mid-February, even if you file early.

- Delays may occur if forms are incomplete or errors are found.

What to Do if Your EITC Application Is Denied

- Review the IRS notice you receive.

- Fix any errors and submit requested documentation.

- You may appeal if you disagree.

EITC and Your State Taxes (Maine Focus)

- Maine offers a refundable credit based on a percentage of your federal EITC.

- Check Maine Revenue Services for the current rate.

Conclusion

The Earned Income Tax Credit provides essential relief for qualifying working individuals and families, sometimes adding thousands to your refund. Reviewing the rules, avoiding mistakes, and claiming both federal and Maine state credits ensures you don’t leave money on the table.

Don’t leave money on the table—apply for your Earned Income Tax Credit today!

FAQs

What is the maximum amount you can receive from the EITC?

- Up to $8,046 for tax year 2025 (three or more children).

Can I claim the EITC if I’m self-employed?

- Yes, if you accurately report all earned income and pay self-employment tax.

Do I need to have children to qualify for the EITC?

- No, adults ages at least 25 but under 65 with low incomes may qualify for a smaller amount.

Where can I get free help with my EITC application?

- IRS VITA sites, AARP Tax-Aide, Maine Revenue Services, and the IRS EITC Assistant.