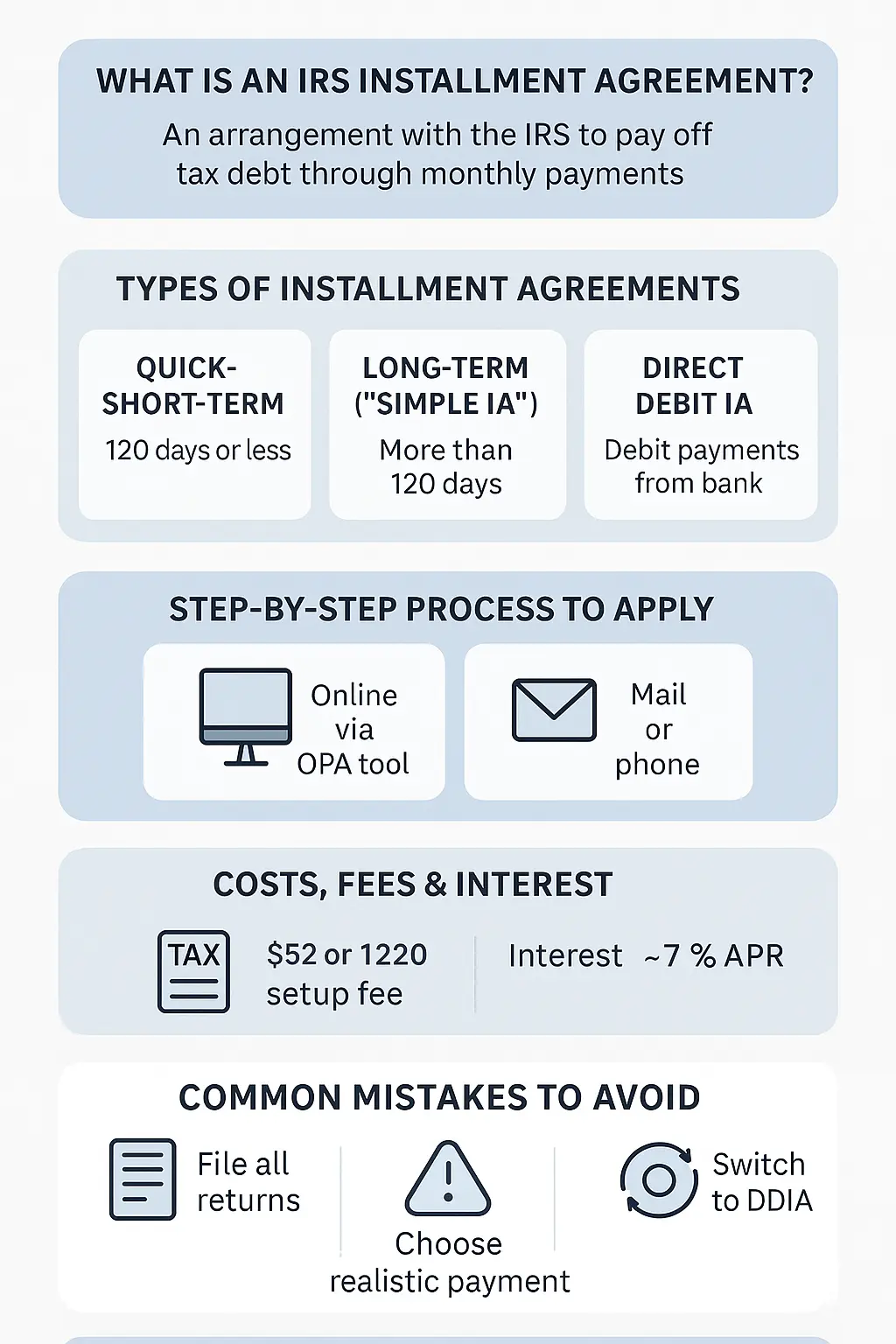

To set up an IRS installment agreement, gather financial details, select a suitable plan, and apply via the IRS Online Payment Agreement tool—or submit Form 9465 (with Form 433-F if needed) by mail or phone.

2025 Updates

2025 IRS Installment Agreement Changes:

Simplified Installment Agreement lets you pay up to $50,000 in tax debt over 10 years. A federal tax lien may be avoided before filing. 7% APR interest applies.

Setup fees: $52 (Direct Debit) or $120 (Standard), reduced for eligible low-income.

Official links: IRS Payment Plans, OPA Tool.

Comparison Table: Agreement Types

| Feature | Short-Term (≤180 days) | Long-Term (Simple IA) | Direct Debit (DDIA) |

|---|---|---|---|

| Max Debt Amount | Unlimited | Up to $50,000 | Up to $50,000 |

| Payment Length | 180 days or less | Up to 120 months or CSED | Often ≤120 months |

| Fees | None | $120 setup | $52 setup |

| Payment Method | Check/Card/MO | Check/Card/Debit | Auto debit |

| Disclosure Needed | Rare | Sometimes | Seldom |

| Lien Risk | Yes (if over threshold) | No (if pre-lien) | No (usually) |

| Apply Online | Yes | Yes | Yes |

Step-by-Step Setup: Online, Mail/Phone

Online Payment Agreement (OPA) Tool:

- Visit the IRS Online Payment Agreement.

- Sign in (ID.me or IRS login required).

- Enter the taxpayer and financial details.

- Choose plan type.

- Select your payment amount/schedule, then review the terms.

- Submit your application and receive instant confirmation.

Mail or Phone (Form 9465, sometimes Form 433-F):

- Complete Form 9465.

- If debt exceeds $50,000, attach Form 433-F.

- Mail form(s) to the IRS address as instructed or as listed on the notice.

- For the phone, call the IRS using the notice number to provide details and fulfill requirements.

Costs, Fees, Interest

- Setup Fees: $52 (Direct Debit), $120 (Standard/Payroll)

- Low-income applicants: reduced/waived fee if eligible.

- Interest Rate: 7% APR for new agreements.

- Failure-to-pay penalty: 0.5% per month up to 25% of tax owed.

- Penalties/interest continue to accrue until paid in full.

- Default/reinstatement fees may apply.

Avoiding Default, Reinstatement & Switching to DDIA

- Default occurs when payments are missed or filings are late. IRS sends CP523 notice.

- To fix: Respond to CP523, pay the missed amount, or call the IRS for reinstatement.

- Change payment amount/date via OPA or by contacting the IRS.

- Direct Debit (DDIA) reduces the risk of default and liens—switch anytime online or by phone.

Alternatives: OIC, CNC, Penalty Abatement

- Offer in Compromise (OIC): Settle for less if hardship is proven.

IRS OIC Info Pros: Debt reduction. Cons: Lengthy and strict process. - Currently Not Collectible (CNC): IRS temporarily stops collection.

IRS CNC Info Pros: Pauses actions. Cons: Debts/interest still accrue. - Penalty Abatement: Penalties reduced for reasonable cause.

IRS Penalty Relief Pros: Cost savings. Cons: Strict qualifying rules.

Worked Example

Taxpayer owes $35,000 (2024 tax year), wants a 10-year (120 months) Simple IA at $330/month:

- Setup fee: $52 (Direct Debit)

- Year 1 interest: $35,000 × 0.07 = $2,450

- Estimated total paid: $330 × 120 = $39,600 + interest/penalties

- Low-income? Reduced/waived fee applies

Common Mistakes & Tips

- File all returns before applying for the agreement

- Choose an affordable payment—don’t overpromise

- Switch to Direct Debit for security

- Never ignore IRS CP523 defaults—act quickly

- Always check the latest IRS payment plan rules before applying

Call to Action

Apply for an IRS Installment Agreement Now

Use the IRS Online Payment Agreement page or download Form 9465 to get started.

Frequently Asked Questions (FAQs)

Can I set up an installment agreement if I owe more than $50,000?

Typically, Form 433-F with Schedule 9465 is required. For debts >$250,000, online option isn’t available.

Will the IRS file a lien if I enter an installment agreement?

A lien is avoided if you act before the IRS files its claim. Stay compliant to prevent a lien.

What happens if I miss a payment?

The CP523 notice will arrive. Pay the outstanding amount or contact the IRS to reinstate your account.

Are interest and penalties paused during my plan?

No, they continue until full payment is made.

How can I apply if I am unable to use the online tool?

Download Form 9465, mail it to the IRS, or call for assistance.

What is the best way to reduce fees?

Use direct debit, and low-income taxpayers may be eligible for reduced/waived fees.

Can I change the monthly payment after starting?

Requests may be made online, by phone, or by mail via Form 9465—approval required.

What documents for Form 433-F?

Detailed financial info: assets, debts, expenses. See IRS instructions.

Is direct debit required?

Not for all, but highly recommended—online application is easier with DDIA.

What if the financial situation changes after starting?

Notify the IRS promptly and request a modification.

Is approval guaranteed?

Most individuals with returns filed and a DDIA receive automatic approval for loans under $50,000.

How do I check the status?

Log in to your IRS account or call the IRS for info.

Sources

- IRS: Payment Plans & Installment Agreements

- IRS: Online Payment Agreement Tool

- IRS: Form 9465

- IRS: Form 433-F

- IRS: Interest Rates Bulletin

- IRS: Offer in Compromise

- IRS: Penalty Relief

Disclaimer: This article is for informational purposes only. For the latest IRS guidance, visit official IRS pages or consult with a tax professional.