Are you leaving money on the table during tax season? Every year, millions of Americans miss out on valuable tax savings simply because they don’t fully understand Tax Credits vs Deductions and how they work. While both can lower your tax bill, knowing the difference between tax credits and tax deductions—and how to maximize them—can lead to significant savings.

This article is designed for individuals, freelancers, and small business owners who want to make smarter tax decisions and keep more of what they earn. Whether you’re filing as a salaried employee, juggling multiple freelance gigs, or running your own business, understanding these two core tax-saving tools is essential for financial health.

Our goal is to demystify tax credits and deductions with clear explanations, real-world examples, and expert insights. By the end, you’ll know precisely how these tools work, how they differ, and how to use them to your advantage, so you can stop overpaying and start saving at tax time.

What Are Tax Credits?

Definition and Function

A tax credit is a financial benefit that directly reduces the amount of tax you owe, dollar-for-dollar. Unlike tax deductions, which lower your taxable income, tax credits subtract from your final tax bill, making them particularly valuable for taxpayers. For example, if you owe $2,000 in taxes and qualify for a $1,000 tax credit, your tax liability drops to $1,000.

Tax credits come in two primary forms:

- Refundable Tax Credits: These can reduce your tax bill below zero, meaning if the credit exceeds your total tax owed, you receive the remaining amount as a refund. For instance, if your total tax liability is $500 and you have a $1,000 refundable credit, you would get a $500 refund.

- Non-refundable Tax Credits: These can reduce your tax bill to zero, but any excess credit is lost; you won’t receive a refund for the unused portion. If your tax owed is $500 and you have a $1,000 non-refundable credit, your tax drops to zero, but you don’t get the extra $500.

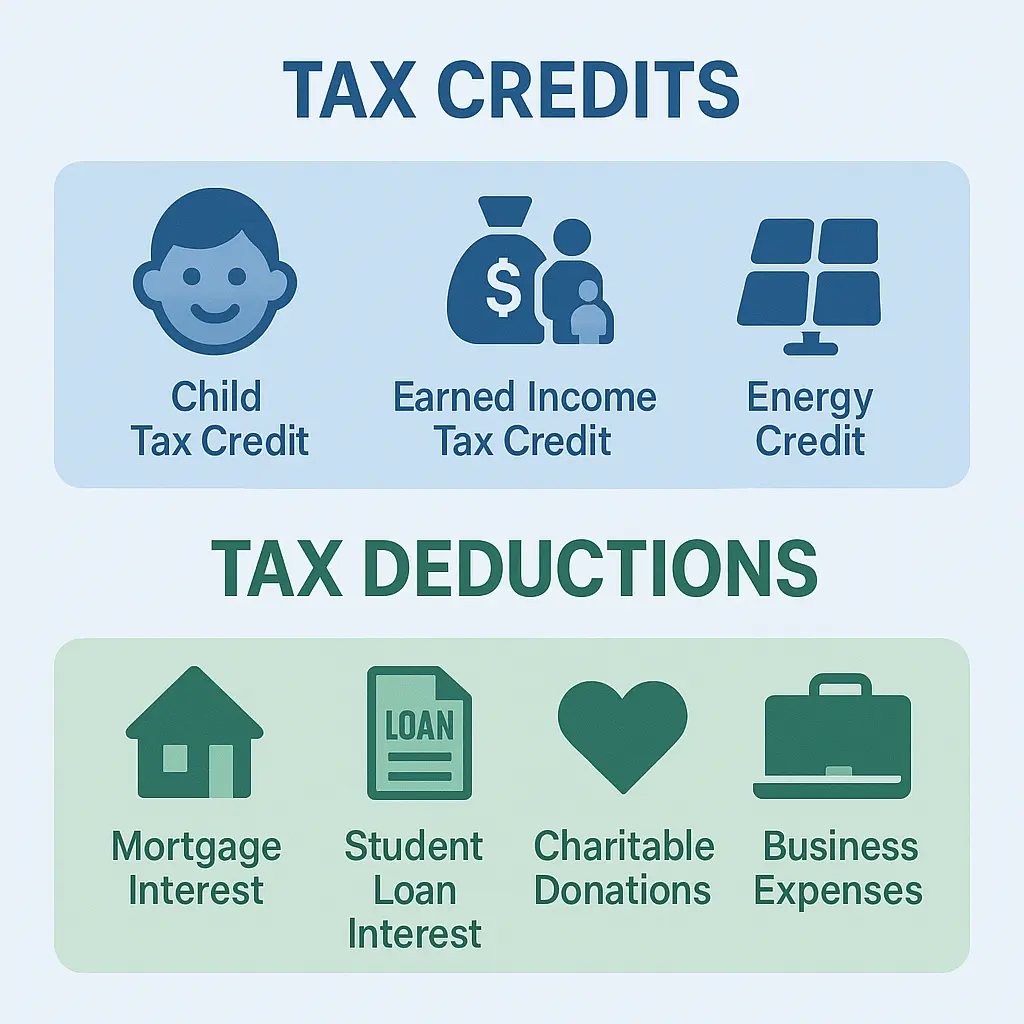

Common Types of Tax Credits

- Child Tax Credit: Designed to help families with qualifying children, this credit is worth up to $2,000 per child for 2025, with up to $1,700 being refundable. It phases out at higher income levels.

- Earned Income Tax Credit (EITC): A major refundable credit for low- to moderate-income workers. The maximum credit varies by the number of qualifying children and can be as high as $8,046 in 2025.

- American Opportunity Credit: This education credit helps offset the cost of the first four years of college. It is worth up to $2,500 per student, with up to $1,000 being refundable. It covers tuition, fees, and course materials.

- Energy-Efficient Home Improvement Credits: Taxpayers can claim up to 30% of qualified expenses for energy-efficient home improvements, such as upgrading insulation, windows, or heating systems. The maximum annual credit is $3,200, depending on the type of improvement.

Tax credits are powerful tools for reducing your tax burden and, in some cases, increasing your refund. Understanding which credits you qualify for and how they work can lead to substantial savings at tax time.

What Are Tax Deductions?

Definition and How They Work

A tax deduction is an expense or allowance that you can subtract from your gross income to arrive at your taxable income, effectively lowering the amount of tax you owe. Deductions reduce your taxable income, not your tax bill directly. For example, if you’re in the 24% tax bracket and claim a $1,000 deduction, you’ll save $240 in taxes. The more income you have, the greater the potential tax savings from deductions, since deductions are more valuable at higher tax rates.

Taxpayers can choose between the standard deduction, a fixed amount set by the IRS each year based on your filing status, or itemize their deductions if their qualifying expenses exceed the standard deduction. You cannot claim both in the same year. The standard deduction for 2025 is $15,000 for single filers and $30,000 for married couples filing jointly.

Common Tax Deductions

- Mortgage Interest: Homeowners can deduct mortgage interest on their primary residence (and sometimes a second home), subject to certain limits. For most, this is one of the most significant itemized deductions.

- Student Loan Interest: You can deduct up to $2,500 in interest paid on qualified student loans, even if you don’t itemize.

- Charitable Donations: Donations made to qualified charities are deductible, with limits generally set at 60% of your adjusted gross income for cash contributions. Donations of property may have different limits and requirements.

- Business Expenses (for Freelancers and Small Businesses): Ordinary and necessary expenses for running a business, such as office supplies, travel, and equipment, are deductible. These deductions are especially important for freelancers and small business owners, as most business expenses can be fully deducted in the year they are incurred.

By understanding and properly claiming tax deductions, you can significantly reduce your taxable income and lower your overall tax liability.

Tax Credits vs Deductions: Key Differences

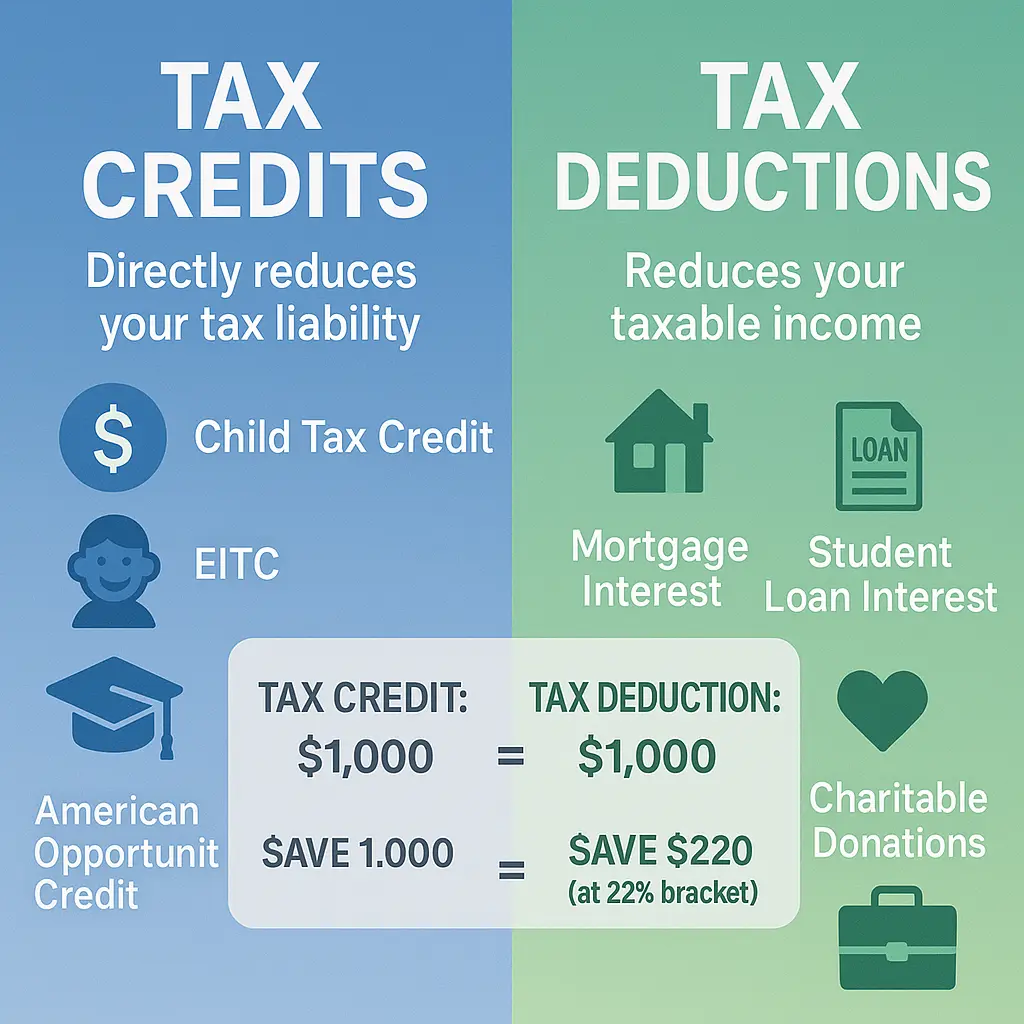

Dollar-for-Dollar vs. Income Reduction

Tax credits and deductions both reduce your tax bill, but in fundamentally different ways. A tax credit provides a direct, dollar-for-dollar reduction in your tax liability. For example, if you owe $3,000 in taxes and receive a $1,000 tax credit, your tax bill drops to $2,000. In contrast, a tax deduction lowers your taxable income, thereby reducing your tax bill based on your tax bracket.

Consider a real-world example for someone in the 22% tax bracket:

- $1,000 Tax Credit: Reduces your tax bill by the full $1,000.

- $1,000 Tax Deduction: Reduces your taxable income by $1,000, saving you $220 (because $1,000 × 22% = $220).

This stark difference shows why credits are often more valuable than deductions of the same dollar amount.

Refundable vs. Non-Refundable Benefits

Tax credits can be either refundable or non-refundable, and this distinction can significantly impact your refund:

- Refundable Credits: If your credit exceeds your total tax owed, you receive the difference as a refund. For instance, if you owe $500 in taxes and have a $1,000 refundable credit, you not only erase your tax bill but also get a $500 refund.

- Non-Refundable Credits: These can reduce your tax bill to zero but cannot generate a refund. If you owe $500 and have a $1,000 non-refundable credit, your tax bill is reduced to zero, with no additional payout.

Refundable credits are especially valuable for lower-income taxpayers, as they can lead to a refund even if you owe no tax.

Who Benefits More From Each?

- Lower-Income Households: Tend to benefit more from tax credits, particularly refundable ones, since credits can reduce tax liability to zero and potentially result in a refund. This direct reduction is crucial for those with little or no tax owed.

- Higher-Income Households: Often gain more from deductions, as the value of a deduction increases with your tax bracket. For example, a $10,000 deduction is worth $3,500 to someone in the 35% bracket but only $1,200 to someone in the 12% bracket.

Understanding these differences helps taxpayers of all income levels strategically maximize their tax savings by choosing the most beneficial mix of credits and deductions for their situation.

FAQs – Common Questions Answered

Q1: Can I claim both tax credits and deductions?

A: Yes, you can claim both tax credits and deductions on your tax return. They apply in different ways: deductions reduce your taxable income, and credits directly reduce your tax bill, so stacking them can maximize your savings.

Q2: What’s better: a $1,000 tax credit or a $1,000 deduction?

A: A $1,000 tax credit is more valuable because it reduces your tax bill dollar for dollar. In comparison, a $1,000 deduction only reduces your taxable income, saving you a percentage of that amount based on your tax bracket. For example, in a 22% bracket, a $1,000 deduction saves you $220, while a $1,000 credit saves you the full $1,000.

Q3: What if my tax credit is more than what I owe?

A: If the credit is refundable, you get the extra amount back as a refund. If it’s non-refundable, your tax liability can only be reduced to zero; any excess credit is lost and not refunded to you.

Q4: Are business deductions different from personal deductions?

A: Yes, business deductions reduce your net business income, which affects your business’s taxable profit. Personal deductions, on the other hand, apply to your adjusted gross income on your individual tax return. The types of expenses and rules for claiming them also differ between business and personal taxes.

Q5: Can tax software help me find all the credits and deductions I qualify for?

A: Absolutely. Most modern tax software is designed to guide you through available credits and deductions, ensuring you don’t miss out on potential savings and helping you maximize your return.

Conclusion

Understanding the difference between tax credits and deductions is essential to maximizing your tax refund or reducing what you owe. Don’t leave your savings to chance; take the time to explore which credits and deductions you qualify for, or consult with a tax professional to ensure you’re getting every benefit available. Whether you’re a W-2 employee, freelancer, or small business owner, making informed tax decisions today can lead to bigger financial rewards down the road.

Bookmark this guide or share it with someone preparing to file, and don’t miss our upcoming post on “Tax Strategies for Self-Employed Professionals.”