The Child Tax Credit is one of the most significant financial lifelines for families in the United States, offering essential support as the cost of raising children continues to climb. In recent years—especially in the wake of the pandemic and amid persistent inflation—this credit has become even more crucial. For millions of parents and guardians, the Child Tax Credit has not only helped offset rising expenses for child care, food, and housing, but has also played a key role in reducing child poverty and providing families with greater economic stability.

If you’re a parent or guardian, understanding the Child Tax Credit could save you thousands on your tax bill. In this comprehensive guide, you’ll learn what the Child Tax Credit is, who qualifies, how much you can claim, and the exact steps to file for it in 2025. Whether you’re new to the credit or want to make sure you’re maximizing your refund, this guide will help you navigate every aspect of the Child Tax Credit and ensure your family gets the support it deserves

What is the Child Tax Credit (CTC)?

The Child Tax Credit (CTC) is a federal tax benefit designed to help families with the cost of raising children. It provides a dollar-for-dollar reduction in your tax bill for each qualifying child under age 17. The CTC was first introduced in 1997 and has since undergone several significant changes to expand its reach and impact for American families.

Key Legislative Changes:

- In 2021, the American Rescue Plan Act (ARPA) temporarily increased the CTC to up to $3,600 per child under age 6 and $3,000 per child ages 6–17, made the credit fully refundable, and allowed monthly advance payments.

- These enhancements expired after 2021, and for tax years 2022 through 2025, the CTC reverted to its pre-ARPA structure: up to $2,000 per qualifying child under age 17, with up to $1,700 of that amount refundable as the Additional Child Tax Credit (ACTC), indexed for inflation.

- Unless Congress acts, the CTC is set to decrease to $1,000 per child and phase out at lower income levels after 2025.

2024–2025 Updates:

- For 2025, the maximum Child Tax Credit remains at $2,000 per qualifying child, with up to $1,700 refundable for eligible families.

- The credit begins to phase out for single filers with modified adjusted gross income (MAGI) above $200,000 and for married couples filing jointly above $400,000.

- The child must have a valid Social Security Number (SSN) and meet all other qualifying criteria.

For the most up-to-date details and eligibility requirements, visit the IRS Child Tax Credit

How Much is the Child Tax Credit Worth?

For the 2025 tax year, the Child Tax Credit (CTC) is worth up to $2,000 per qualifying child under age 17. This credit is designed to directly reduce your tax bill on a dollar-for-dollar basis, making it one of the most valuable tax breaks for families.

Refundable vs. Non-Refundable Portions

- Non-Refundable Portion: The CTC first reduces your tax liability. If the credit brings your tax bill to zero, any remaining unused portion may be refundable.

- Refundable Portion (Additional Child Tax Credit, ACTC): For 2025, up to $1,700 per child can be refunded to you if your credit exceeds your tax liability and you meet certain income requirements. This ensures that even families with little or no tax owed can benefit from the credit.

Table: 2025 Child Tax Credit Breakdown

| Credit Component | 2025 Amount per Child | Refundable? |

| Standard Child Tax Credit (CTC) | $2,000 | Partially |

| Additional Child Tax Credit | Up to $1,700 | Yes (if eligible) |

Example:

If you have two qualifying children and owe $1,500 in federal taxes, you could use $1,500 of your $4,000 total CTC ($2,000 x 2) to bring your tax bill to zero. If you meet the income and other requirements, you could receive up to $1,700 per child ($3,400 total) as a refund for the unused portion.

Note: The CTC is scheduled to revert to $1,000 per child after 2025 unless Congress extends the current provisions.

Who Qualifies for the Child Tax Credit?

To claim the Child Tax Credit for 2025, both the taxpayer and each child must meet specific IRS requirements. Here’s a breakdown of the main eligibility criteria:

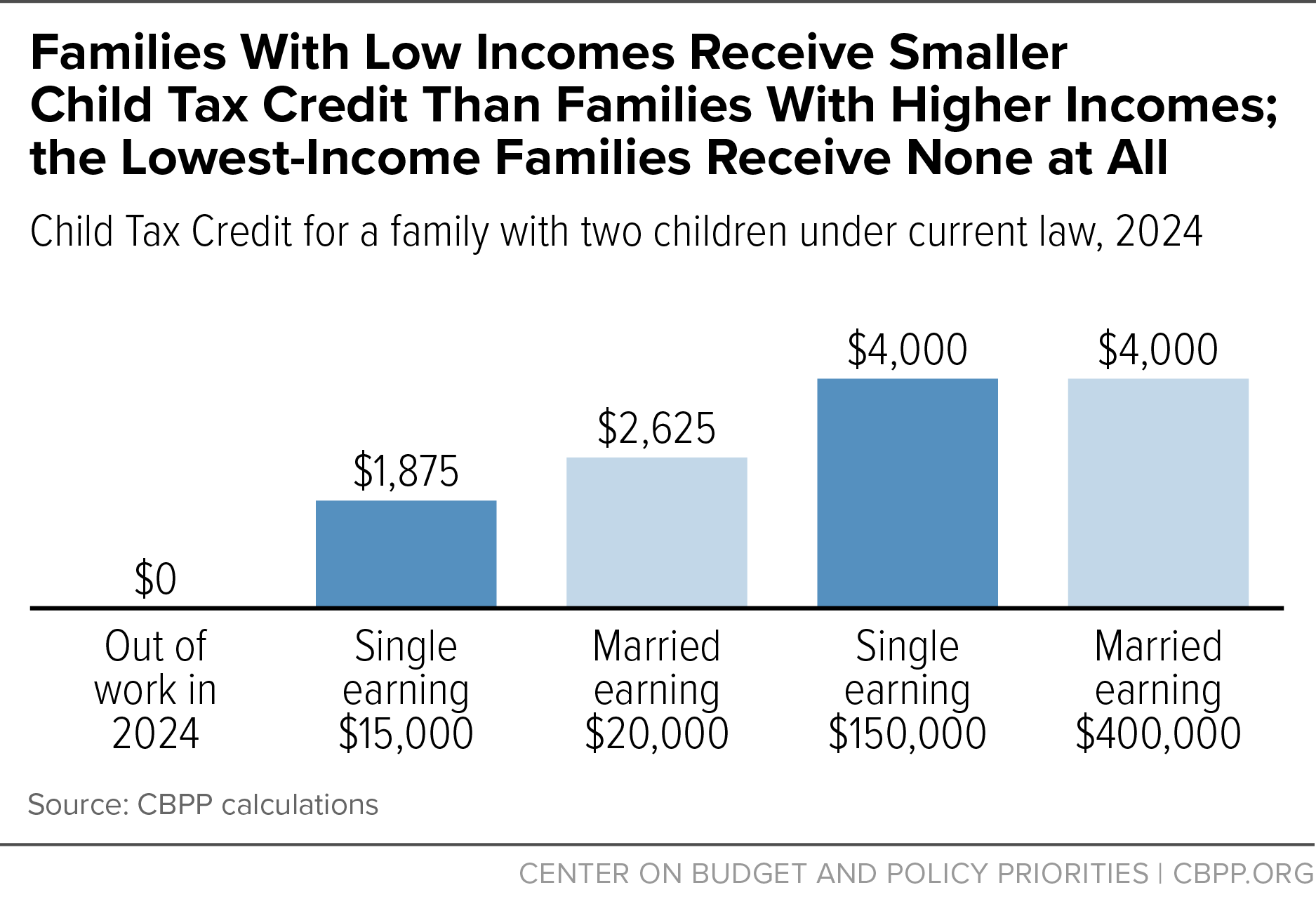

Income Limits

- The CTC begins to phase out at higher income levels.

- Your Modified Adjusted Gross Income (MAGI) must be below the following thresholds to qualify for the full credit:

| Filing Status | Full Credit If Income Below | Phase-Out Begins At |

| Single | $75,000 | $200,000 |

| Head of Household | $112,500 | $200,000 |

| Married Filing Jointly | $150,000 | $400,000 |

- For every $1,000 (or part thereof) your income exceeds the phase-out threshold, your credit is reduced by $50.

Age Requirements

- The child must be under 17 years old at the end of the tax year (December 31, 2025).

- The child must have a valid Social Security Number (SSN) issued before the due date of your tax return.

Relationship & Residency Test

- The child can be your:

- Son, daughter, stepchild, foster child

- Brother, sister, half-brother, half-sister, stepbrother, stepsister

- Or a descendant of any of these (e.g., grandchild, niece, nephew).

- The child must have lived with you for more than half of the year (some exceptions apply for temporary absences such as school, medical care, or military service).

Support Test

- You must have provided more than half of the child’s financial support during the year.

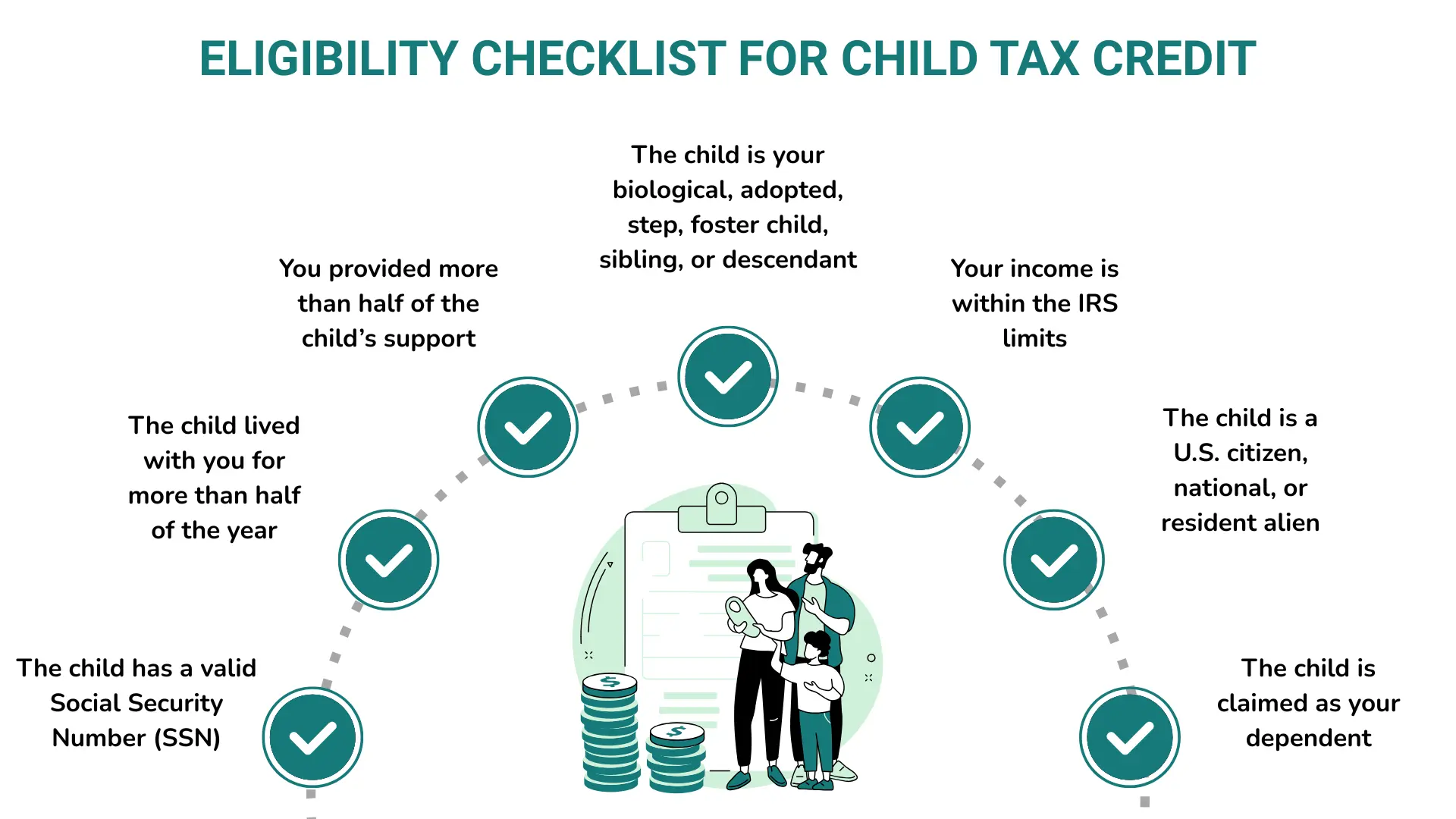

Quick Eligibility Checklist:

- Child is under age 17 by December 31, 2025

- Child has a valid SSN

- Child is your biological, adopted, step, foster child, sibling, or descendant

- Child lived with you for more than half the year

- You provided more than half of their support

- Child is claimed as your dependent

- Child is a U.S. citizen, national, or resident alien

- Your income is within the IRS limits

How to Claim the Child Tax Credit

Claiming the Child Tax Credit for 2025 is a straightforward process if you follow these key steps:

- Gather Dependent Information

- Collect your child’s Social Security Number (SSN)

- Have their date of birth and proof of residency (such as school or medical records)

- Gather your income documents (W-2s, 1099s) and your tax return (Form 1040)

- Fill Out Schedule 8812 (Form 1040)

- When preparing your 2025 tax return (filed in 2026), enter your dependents on Form 1040

- Complete and attach Schedule 8812 to calculate the refundable portion of the credit

- Use Tax Software or Hire a Tax Preparer

- Most tax software will guide you through the Child Tax Credit section with step-by-step questions and auto-fill the required forms

- If your situation is complex or you want peace of mind, consider hiring a tax professional

- File Before the Deadline

- The standard IRS tax filing deadline is April 15, 2026 (unless changed)

- Filing early and opting for direct deposit can help you receive any refund faster

Pro Tip: Even if you owe no federal tax, you should still file to claim any refundable portion of the Child Tax Credit.

Common Mistakes to Avoid

Avoiding common mistakes when claiming the Child Tax Credit is essential to prevent delays or denials of your refund. Here are the top errors and how to fix them:

- Claiming a non-qualifying child

- Mistake: Attempting to claim a child who does not meet IRS requirements (age, relationship, residency, support, or SSN criteria).

- How to Fix: Double-check that your child meets all IRS eligibility tests before filing. Use tax software or consult a tax professional if you’re unsure.

- Incorrect SSN

- Mistake: Entering an invalid, missing, or incorrect Social Security Number for your child. The IRS requires a valid SSN, not an ITIN, issued before the tax return due date.

- How to Fix: Ensure you have your child’s official SSN before filing. For newborns or recent adoptions, wait until the SSN is issued. If you don’t have it by the deadline, file for an extension, but pay any taxes owed to avoid penalties.

- Overstating income

- Mistake: Reporting income that is too high, which can phase out or eliminate your CTC eligibility.

- How to Fix: Accurately report your Modified Adjusted Gross Income (MAGI) and review IRS phase-out thresholds. Use reliable tax software or a preparer to minimize errors.

- Forgetting to file Schedule 8812

- Mistake: Not attaching Schedule 8812 with your Form 1040, which is required to calculate and claim both the refundable and non-refundable portions of the credit.

- How to Fix: Always complete and attach Schedule 8812 when claiming the CTC. Tax software typically includes this automatically, but double-check before submitting your return.

Pro Tip: If your CTC claim is denied due to an error, you may need to file Form 8862 with your next return to reclaim the credit.

Child Tax Credit vs. Other Tax Benefits

Here’s a clear comparison of the Child Tax Credit (CTC) and other major tax benefits for families, to help you choose the right credits and avoid confusion:

| Credit/Benefit | Age Limit | Refundable? | Max Amount (2025) |

| Child Tax Credit (CTC) | Under 17 | Partially ($1,700) | $2,000 per child |

| Dependent Care Credit | Under 13 | Yes | Up to $3,000 per child |

| Earned Income Tax Credit (EITC) | Varies by child (under 19, or 24 if a student, or any age if disabled) | Yes | Varies by income and number of children |

Key Differences:

- Child Tax Credit (CTC):

- Helps families offset the general costs of raising children (food, housing, clothing, etc.).

- Partially refundable: Up to $1,700 per child can be received as a refund if your tax liability is less than your total credit.

- Child must be under 17 and have a valid SSN.

- Dependent Care Credit:

- Specifically designed to help working parents offset the cost of child care for children under 13.

- Fully refundable: You can receive the credit even if you owe no tax.

- Maximum credit is up to $3,000 for one child or $6,000 for two or more.

- Earned Income Tax Credit (EITC):

- Supports low- to moderate-income workers; the amount depends on your income and number of qualifying children.

- Fully refundable: You can receive the credit as a refund even if you owe no tax.

- Age limits for children are broader: under 19, or under 24 if a full-time student, or any age if permanently disabled.

You can often claim more than one of these credits if you qualify, maximizing your tax refund and support for your family’s needs.

FAQs: Child Tax Credit 2025

- Is the Child Tax Credit refundable in 2025?

Yes, the Child Tax Credit is partially refundable in 2025. Up to $1,700 per qualifying child can be refunded to you through the Additional Child Tax Credit (ACTC), depending on your earned income and other eligibility requirements. - Can I claim the Child Tax Credit without income?

You generally need at least $2,500 in earned income to qualify for the refundable portion of the credit. Without earned income, you cannot receive the ACTC, but you may still use the non-refundable portion to reduce your tax liability if you owe taxes. - What if my child was born in December?

If your child was born at any point during the year, including December, you may claim the Child Tax Credit for that tax year as long as your child meets all other requirements, such as having a valid SSN and being your dependent. - How does the IRS verify dependents?

The IRS matches the Social Security Number, date of birth, and relationship information you provide with government records. If there are discrepancies or duplicate claims, the IRS may request additional documentation. - What if both parents claim the same child?

The IRS applies tie-breaker rules: the parent with whom the child lived the longest during the year gets the credit. If time is equal, the parent with the higher income claims the child. Duplicate claims can delay or deny the credit until resolved.

Here are the detailed IRS answers to common questions about eligibility, dependents, and filing requirements for the Child Tax Credit.

Final Tips & Resources

Here are some final tips and trusted resources to help you make the most of the Child Tax Credit for 2025:

- Use the IRS Child Tax Credit Tool:

The IRS provides an official online tool to check your eligibility and get answers to common questions. Access it at the [IRS Child Tax Credit page]. - Consult a Tax Professional:

If your tax situation is complex or you’re unsure about eligibility, consider reaching out to an Enrolled Agent (EA) or a qualified tax professional. They can help you maximize your credit and avoid costly mistakes. - Leverage Tax Filing Software:

Filing with reputable tax software like TurboTax, H&R Block, or IRS Free File can simplify the process. These platforms guide you step-by-step, help you complete Schedule 8812, and ensure you claim every dollar you’re eligible for.

Taking these steps will help you claim the Child Tax Credit confidently and accurately.

Conclusion

The Child Tax Credit remains one of the most valuable tax benefits available to families in the United States, offering crucial financial relief to help cover the rising costs of raising children. By reducing your tax bill and potentially providing a refundable credit, it can save you thousands of dollars each year.

Before filing, be sure to double-check your eligibility to ensure you and your children meet all IRS requirements. Proper documentation and accurate reporting are key to maximizing your credit and avoiding common pitfalls.

Have questions? Feel free to comment below or consult a trusted tax professional to get personalized guidance. Your family’s financial well-being is worth the effort!